Financial Intelligence is part of the Business Intelligence Division of Informa PLC

This is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Crucial insight on FX trends | Understand currency exposure and risk| Compare historical data

Forex Allocations. Bullish sentiment. Emerging markets.

Collecting the allocations of funds to currencies

EPFR collects data on allocations of funds to currencies and has done so since 2015. These allocations can be used to drive several remunerative quantitative strategies. The data for a given month is available one month and eight to 11 days later (T+38-42).

Emerging Market Bullish Sentiment Indicator

EPFR’s Bullish Sentiment Indicator, applied to currencies, is the percentage of active funds overweight that

currency vis-à-vis that fund’s own benchmark.

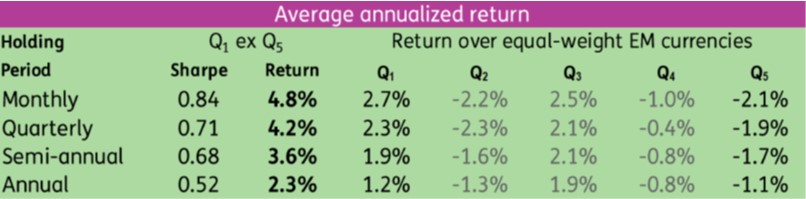

The table below shows the average return difference between the top and bottom fifth of Emerging Market currencies, sorted on the Bullish Indicator, averaged over the latest three months, for various holding periods.

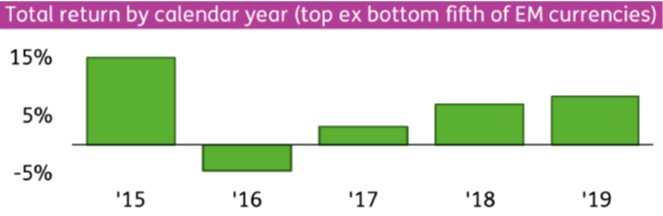

For monthly holding periods, total return differences between the top and bottom fifth of EM currencies, for each calendar year, are reported below.