Financial Intelligence is part of the Business Intelligence Division of Informa PLC

This is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Informa

Best Investment Management Solution for Top Financial Advisors and Wealth Managers

PORTFOLIO PERFORMANCE

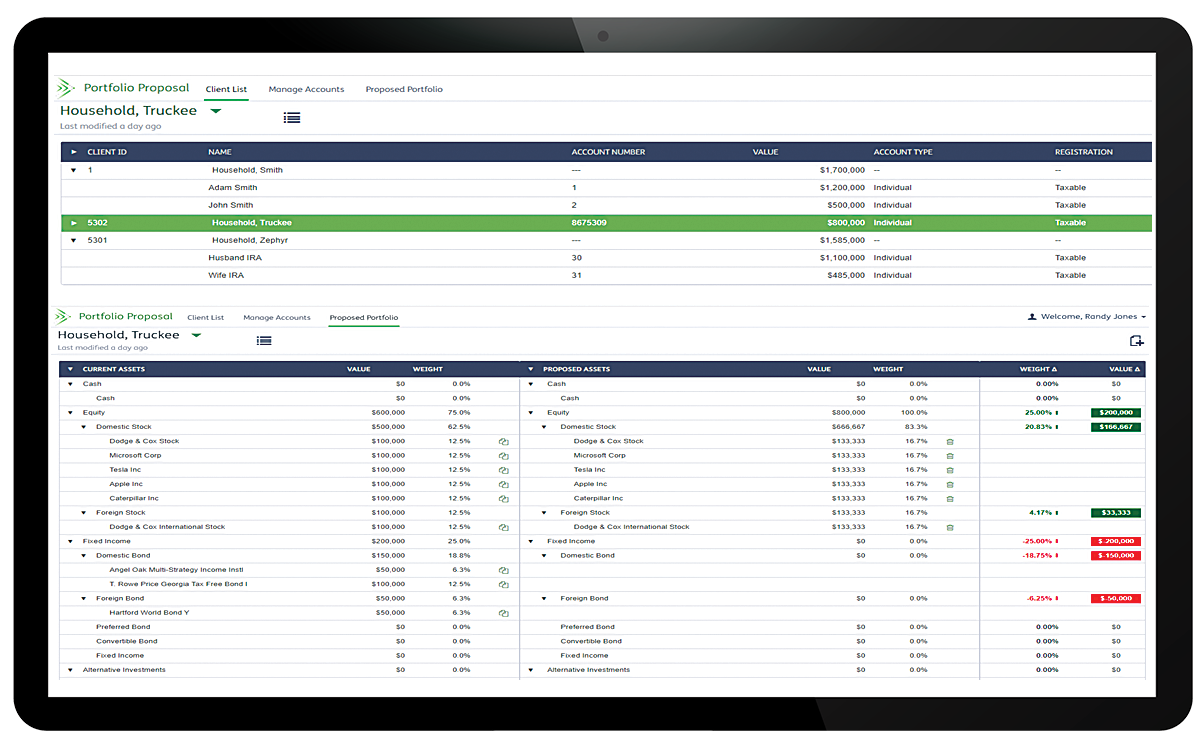

PORTFOLIO GENERATION

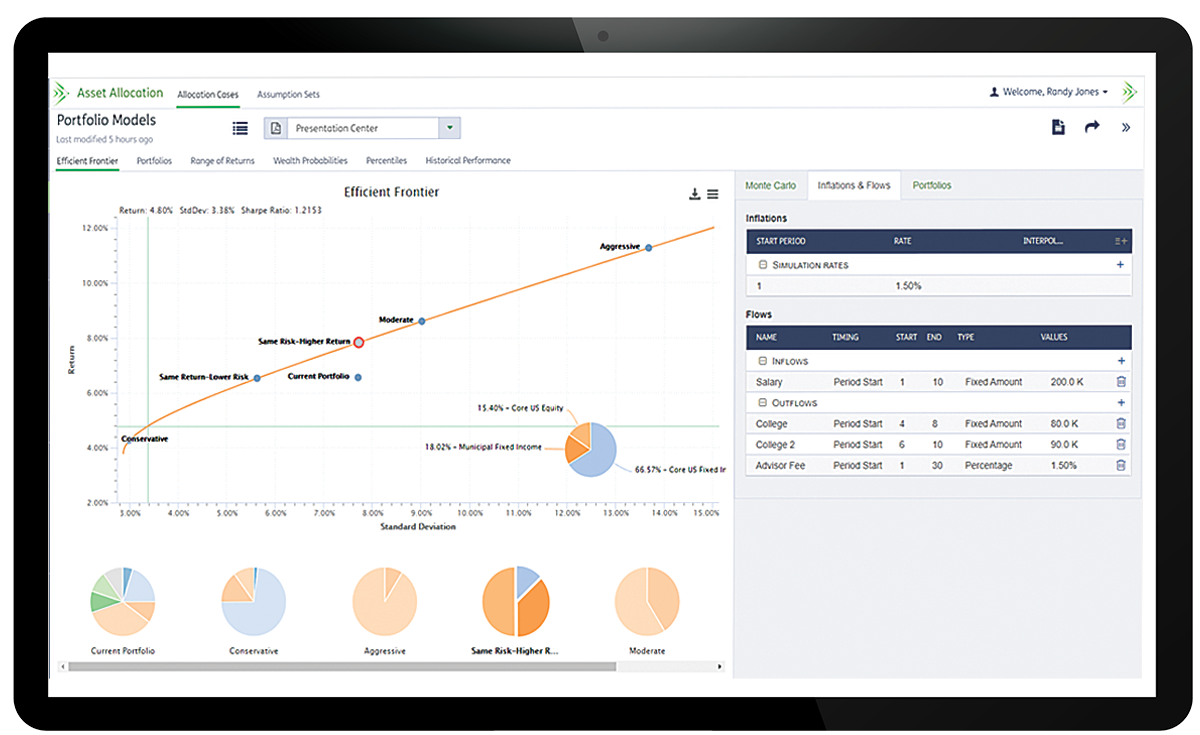

ASSET ALLOCATION

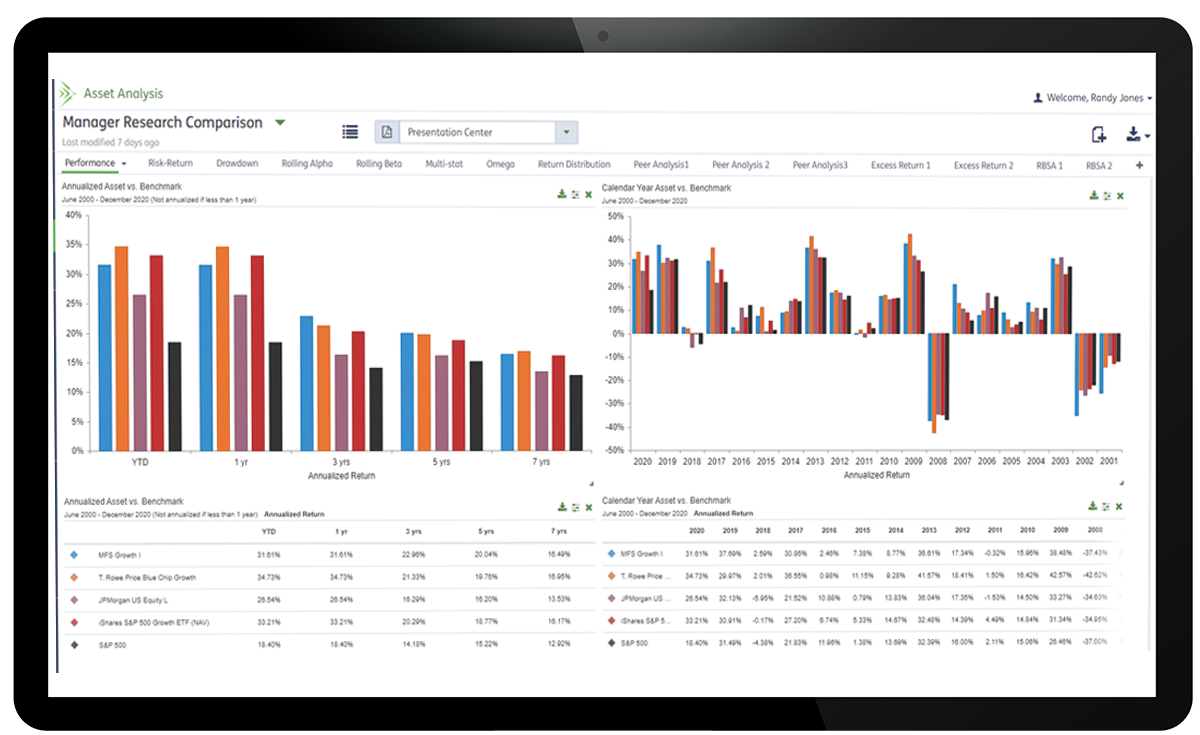

RESEARCH

MANAGER SCREENING

PRESENTATION CENTER

ESG RATINGS

Winner of the 2022 FinTech Breakthrough Awards for Best Financial Research and Data Company

Request a Zephyr demo. It will be the strongest ROI you will earn today.

"I use Zephyr for asset allocation modeling, manager comparisons and manager assessments. It offers better manager tracking than other applications I’ve used."

CLIENT ACQUISITION

AND RETENTION

Keep your investors engaged with reproposals, reports on emerging trends, and generic proposals that can be easily shared to encourage introductions.

ENHANCED

TECHNOLOGY

Never lose important data! Our technology team makes sure all migrations are mapped and seamless. Zephyr's partnership with AppCrown connects Salesforce Financial Services Cloud in minutes, increasing ROI and reducing issue related to manual integration.

RESEARCH

AND DATA

Award-winning research and data is fully customizable and easily filtered to identify vital trends. PSN pioneered the formation of an SMA database and remains a number one choice of 90 percent of top plan sponsors.

INVESTOR

EXPERIENCE

Every email, phone call, text, or in-person meeting is defined as investor experience. How did you do? Purposeful connecting is about building relationships and defining how you want to be viewed by your client.

LOOK INSIDE ZEPHYR

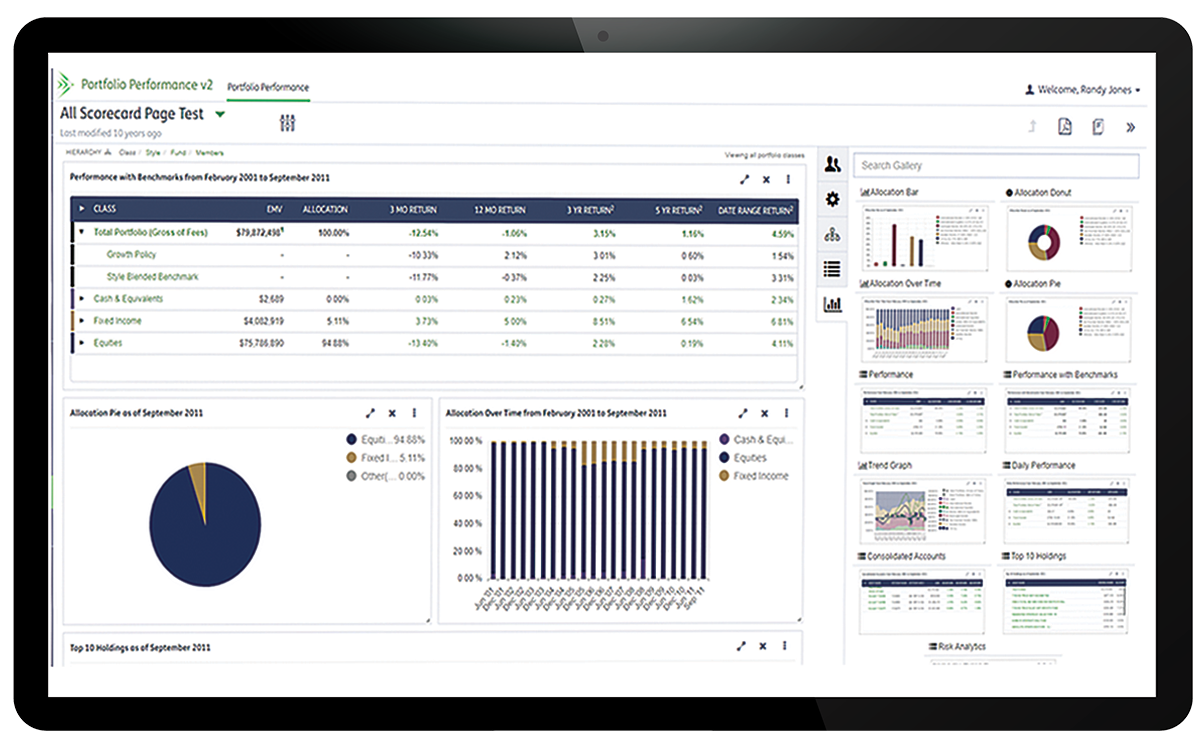

Professional Proposals and Presentations

Create custom professional presentations and reports or choose from our extensive library of over 100 templates with an easy drag and drop module. Validate your success relative to 46,000 benchmarks and build stronger relationships with your investors by creating customized, branded reports in minutes.

Market and Manager Research

Screen thousands of investment portfolio products with powerful sorting, filtering and statistical tools as well as tracking and compare multiple investment products and run Returns Based Style Analysis using 200+ key statistics.

Asset Allocation

Build portfolios using classic mean variance optimization or our sophisticated Black-Litterman optimization module. Estimate the probability of meeting future wealth goals using the Monte Carlo simulation module, and quickly and easily evaluate a portfolios composition including asset allocation, equity and fixed income characteristics, sector and regional weightings, top ten holdings and country exposure.

Portfolio Performance Reporting

Quickly and efficiently analyze performance and calculate returns at various levels, including total portfolio, class level, subclass or style level, and individual asset level. Benchmarking from over 1000 market indices provides a full overview of performance. Integrated with all trust, accounting and custodial systems.

Copyright © 2021 Informa PLC

Informa UK Limited is a company registered in England and Wales with company number 1072954 whose registered office is 5 Howick Place, London, SW1P 1WG. VAT GB365462636. Informa UK Limited is part of Informa PLC.